Read all about it

If it’s in the news and it relates to our services, clients and latest trends in Financial Planning, you’ll find it here.

Our experts are certainly not short of opinions and are always happy to share any new insights they have on all matters to do with your future financial wellbeing.

If you’d like to know more about any of the issues highlighted in these articles, just ask.

Essential tips for university students

Now that you’ve packed your young adults off to University and they’ve survived the trials of Freshers’ Week, it’s important to ensure they’re prepared for other challenges University will bring – finances! The following is a handy guide designed to enable them to survive the next three or four years financially:

Why Cash Flow Modelling is Key to a Successful Retirement Plan

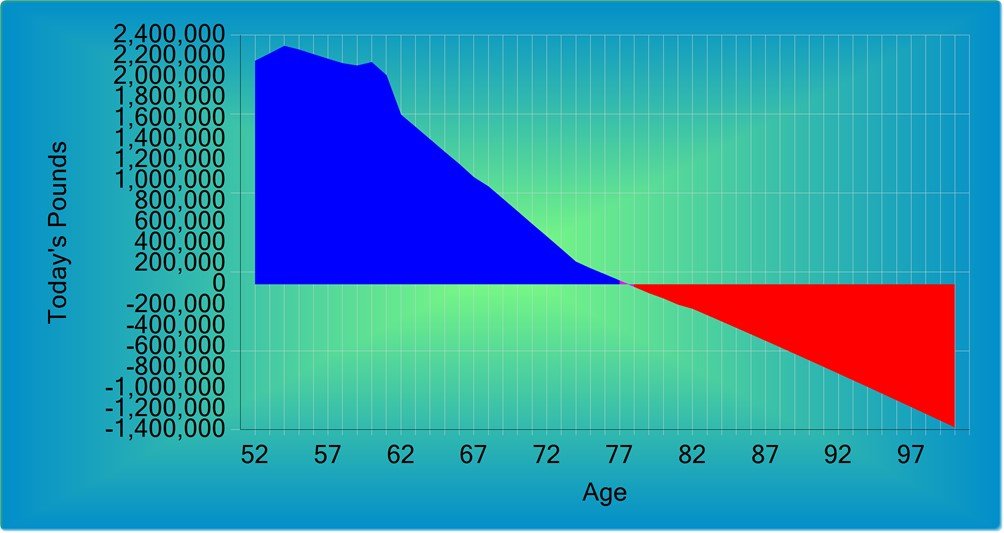

At Broadway Financial Planning (BFP), we believe that planning for retirement is one of the most critical financial decisions you will ever make. To ensure that your retirement years are as comfortable and secure as possible, it's essential to have a clear and detailed understanding of your financial future. One of the most effective tools we use to achieve this is cash flow modelling. In this article we explain why it should be a cornerstone of your retirement planning strategy

Helping your grandchildren leave university debt free

With September approaching, more than 550,000 students are expected take up places at UK universities this year. What should be an exciting new chapter in their lives can be hampered by worry of affordability.

Common investment mistakes, are you guilty of these?

Investing can seem overwhelming and complicated and so it’s easy to overlook various important elements when managing this for yourself. We thought it useful to share our top tips for avoiding the most common mistakes when investing.

What NOT to Include in Your Will: A Guide to Avoiding Common Mistakes

Creating a will is a crucial aspect of estate planning, allowing you to ensure that your assets are passed to those of your choosing when you die. However, it’s something that’s easy to overthink which can lead to unnecessary detail being included. This can then result in confusion, disputes, and even legal challenges. To ensure your wishes are carried out smoothly and to minimise stress on your loved ones at an already difficult time, here's a guide on what not to put in a will.

Mastering Student Budgeting: Essential Tips for University Students

Starting university is such an exciting chapter in life, however, it also marks the start of financial independence and responsibility for many students. The way in which you manage your finances will make or break your time at university, so it is crucial that you get on top of this to ensure a smooth academic journey and set the foundation for your future financial stability. Here we have set out some essential budgeting tips for those embarking on the journey…

The rise of the pension millionaire

Here at BFP, we love an interesting statistic when it comes to personal finance. Recently, we have been discussing as a team some information released by the Office of National Statistics relating to recent research into pension funding in the UK.

Quick tips for a financial health check

If the last few years have taught us anything, it’s that nothing stays the same for long. From lockdowns and furloughs to the cost-of-living crisis and the highest inflation rate seen for 40 years, each of us each will have been affected differently. Right now, with so much uncertainty about the future, our financial health is more important than ever. Here we set out our top-tips on how best to get a grip on your finances

The Sandwich Generation – are you feeling the squeeze?

Are you a part of, or soon to be a part of, the ever-growing generation of people responsible for caring for their own children as well as ageing parents? When we last wrote about this topic, we had focused on the ‘Gen Xs’ who are between their mid-40s and 60s and how this situation could be impacting their retirement planning. A couple of short years later, accelerated no doubt by the cost of living crisis, it’s an issue that continues to spread further across age groups with ‘millennials’ between their late 20s and early 40s now joining the ‘sandwich generation’ club in droves. As a result, this is leading to some worrying statistics.

5 questions to ask your employer about your pension

If you are already a part of a work place pension or if you’ve just started a new job, it’s a good idea to get a understanding of the scheme they are offering. We believe that the following questions are important and could make a significant difference to your pension.